December 2, 2025

Endless celebrates 20th anniversary with stellar year, targets further investments into Yorkshire Businesses in 2026

As the Leeds headquartered firm celebrates its 20th anniversary, Endless remains committed to supporting the development of great Yorkshire businesses.

Having invested in over 100 businesses to date, Endless is proud to be a longstanding and established member of the local Private Equity community who has been trusted with the ownership and development of many great Yorkshire businesses.

Endless was formed in Leeds in 2005 and has developed and grown over the last 20 years – now operating with two investment funds and teams, Endless (a £400m fund) and Enact (a £100m fund). We invest between £1m and over £100m into businesses with revenues greater than £15m. The two fund approach gives us reach across the majority of established businesses in the region, while keeping focus on the important differences between growing pains of SMEs and the strategic development of larger businesses.

2025 has been a great year for Endless, both in terms of new investment activity, as well as securing strong returns on existing investments, with highlights including:

- The acquisition of the Ecobat Battery Division (now called Veloris) from its US headquartered parent

- The acquisition of the hire division from listed parent HSS Hire Group

- Seven exits, including the sale of three Yorkshire based businesses in EVO Business Supplies to its management team, Realise to AQA and Karnova Food Group to OSI.

An investment approach fit for the region

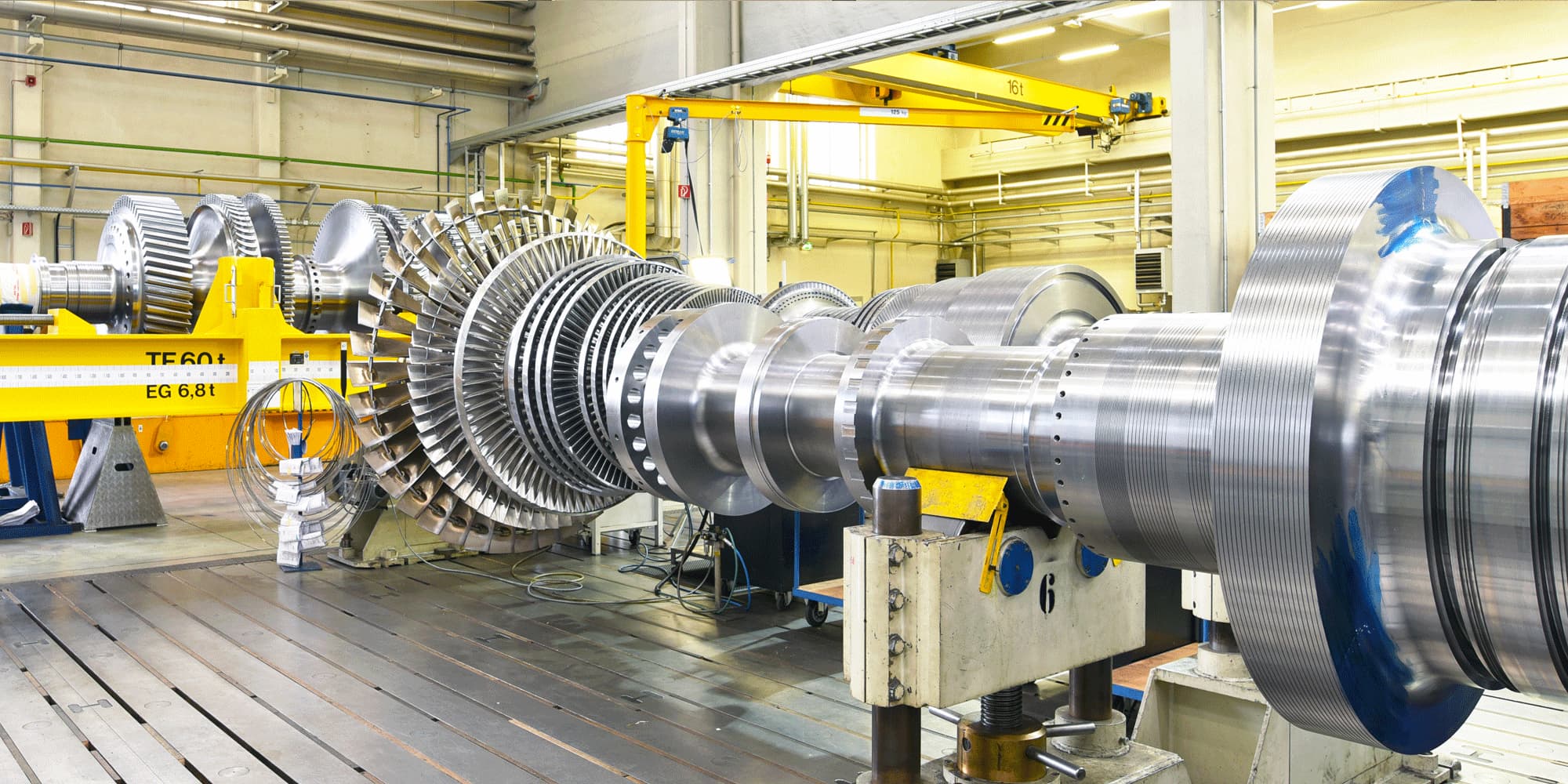

We have a long track record of investing and developing companies across a wide range of sectors, including manufacturing, business services, industrials, engineering and many more.

Endless and Enact offer solutions that others can’t. We specialise in tailored investment strategies that address the unique challenges and opportunities of each business. From nurturing the next generation of family-owned enterprises to revitalising established companies, our approach is designed to unlock latent potential and drive significant growth.

Throughout the deal, we focus on speed and deliverability, often making investments in a matter of weeks – something that we can only do because of our unique approach. We routinely undertake all financial and commercial diligence in house and in most investments, we fund the entire transaction with no requirement to obtain third party bank funding on completion. These two elements can remove significant time from an acquisition process, meaning we are the only decision maker a seller is dealing with and together, we control the pace and delivery of the deal.

Owner-managed businesses

Endless and Enact aim to be transformational investors. We look for opportunities to work closely alongside management teams to evolve and grow our businesses, often whilst facilitating an exit or partial exit for the founder/family owners.

Business growth is delivered through M&A activity, capital investment into facilities and operations, or working to deliver a new strategic direction for the business. We don’t expect the businesses we invest in to be the fully finished article.

A recent example is the Endless investment in Karnova, created through acquisition and integration of two privately-owned businesses, Yorkshire Premier Meat and Smithfield Murray in 2022 and 2023 respectively.

The initial acquisition of Yorkshire Premier Meat saw Endless support the existing management team whilst allowing the founding shareholders to exit their remaining stake. We were able to offer the exiting shareholders a rapid, highly deliverable transaction despite the ongoing economic and political uncertainty – closing the deal in only four weeks from agreeing outline terms and minimising the disruption to the business.

Following the subsequent acquisition of Smithfield Murray, the combined group became one of the UK’s leading value-add business-to-business protein ingredients suppliers with revenues of over £135 million.

During our investment, the group delivered significant growth, with new and existing customers, focused on quality and service.

In February 2025, we successfully exited our investment in Karnova to OSI Group, a US-based privately owned global food business.

As owner-managers consider the implications of the upcoming Autumn Statement, changes in strategy may be required. Endless and Enact can offer a wide range of investment structures to align with the shareholders short and medium-term objectives.

Carve-outs from larger groups

Both Endless and Enact also have a long history of being trusted with the non-core divisions of larger groups, often international and/or listed owners.

Enact supported the carve out of a leading provider of Apprenticeships and Adult Education in October 2020, acquiring the business previously known as Interserve Learning & Employment from the Interserve Group. The carve out saw the company become a standalone training provider and was rebranded as Realise Training.

Our experience in non-core acquisitions and reputation of being a good home for businesses meant that Enact was the preferred partner to support Realise in its transition to new ownership and preparation for the next phase of growth.

Following the investment, Enact supported the business in several areas from investing in people and culture, M&A activity (including three bolt-on acquisitions) and the development of a long-term growth strategy.

Following the successful delivery of these growth initiatives, the business was sold to AQA, a not-for-profit education charity and the UK’s leading exam board for GCSEs and A-levels, in October 2025.

What’s next for the Endless and Enact Funds?

More of the same! If you’d like to discuss a potential sale of your business or a part of the business you work at, we’d love to speak to you.

I lead our investment activity in the region for Endless along with David Isaacs, with Chris Cormack and Paul Denvers lead for Enact. We love to learn about local businesses and explore whether we might be able to deliver a transaction to meet your needs and the needs of all stakeholders.