July 28, 2010

Crown paints bright future after successful turnaround

Crown Paints Group Limited (“Crown” or “the Group”), the largest independent decorative coatings manufacturer in the UK and Ireland, has achieved a successful turnaround of the previously loss-making business following its 2008 buyout from Dutch coatings manufacturer, Akzo Nobel, backed by private equity firm, Endless LLP (“Endless”).

Recently-filed financial accounts for the Lancashire-based firm show a move to an operating profit of £2.8m on sales of £179.2m in the year to 31 December 2009, despite a continued decline in the global coatings market during the recession. This is in stark contrast to the £11.4m loss incurred during the three months’ trading to 31 December 2008 against turnover of £37.8m, following completion of the management buyout of the business on 30 September 2008.

Immediately after the buyout, Crown entered a period of substantial reorganisation, reducing headcount by nine per cent in order to boost efficiency. The Group also undertook a comprehensive review of its global stock inventories and management policies, working closely with retailers to drive fixture productivity and profitability, and with suppliers to drive value through the supply chain.

Adopting a more flexible structure and entrepreneurial approach as an independent business, Crown has taken advantage of profitable sales opportunities, including export and licensing agreements in overseas markets, on the back of a reduced cost structure. In the UK, the Group achieved a 22.5 per cent increase in retail sales volumes in 2009, despite the ongoing depression in consumer spending and market growth of just 0.2 per cent*.

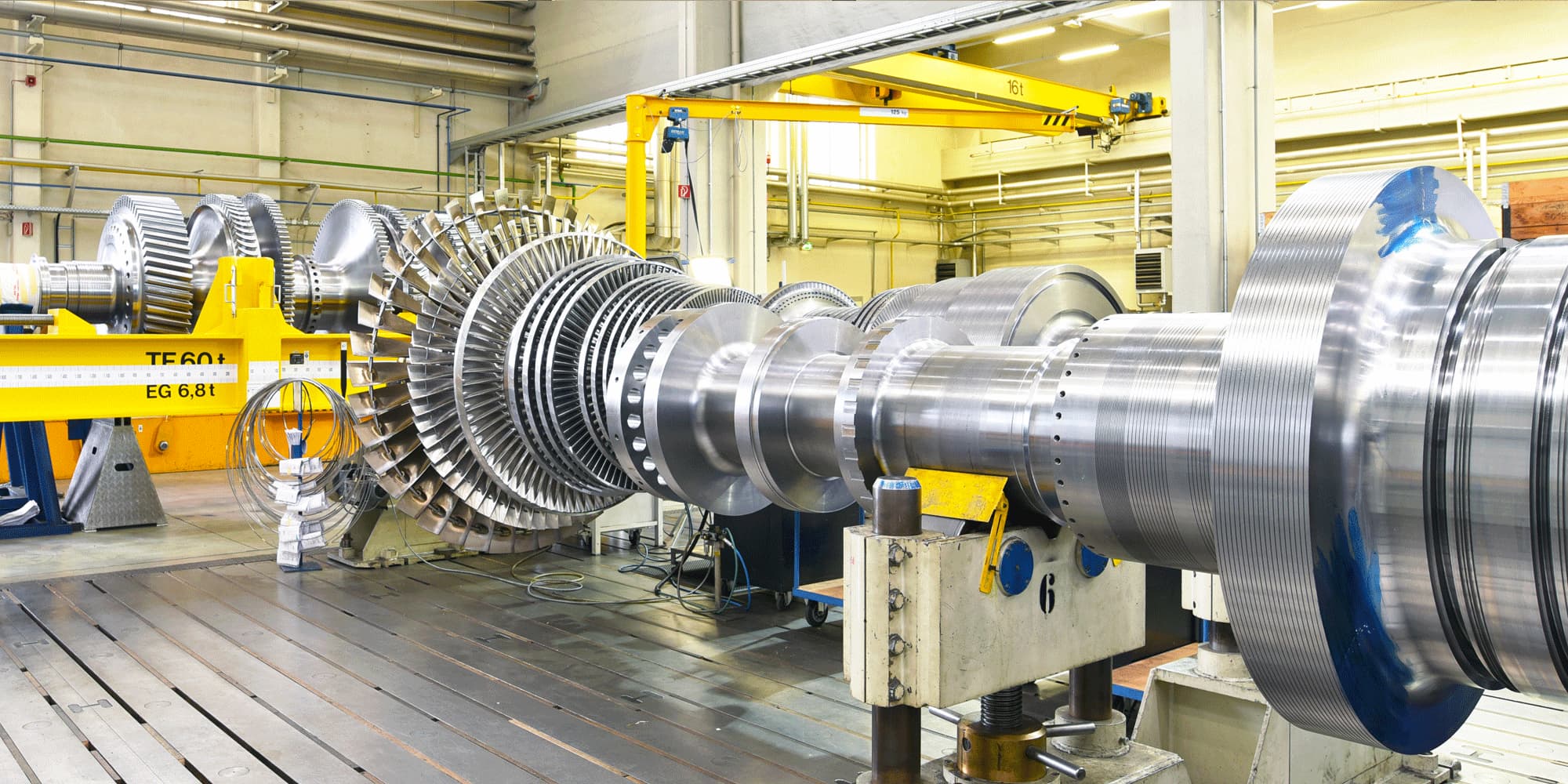

At the same time, with the support of Endless, Crown has begun a programme of infrastructure investment in its facilities, plant and machinery, as well as its wholly owned distribution network of Crown Decorator Centres, opening or significantly refurbishing 12 centres across the UK and Ireland in the year.

During 2009, the Group also invested to build a heavyweight senior management team, recruiting Mike Polkinghorn as operations director from Sherwin Williams and Darryl Senior as purchasing director from Damartex and Sigma Kalon. The year’s recruitment drive culminated in December 2009 with the arrival of new group chief executive, Brian Davidson, from Alexander Dennis (“ADL”), the UK’s largest bus and coach maker. Prior to joining ADL as chief operating officer, Davidson held the roles of chief executive and chairman of Plaxton Holdings, where he led the management buyout and ultimate sale to ADL. Brian also holds a position on the management board of Fairline Boat Holdings Ltd, a luxury yacht manufacturer in Peterborough. In the early part of 2010, the board was strengthened further with the arrival of financial director, Kathryn Hill, from TrenStar Inc, where she was European finance director.

Brian Davidson said: “Following the buyout from Akzo Nobel and a complex separation process, there remained a number of legacy challenges in the business that had to be overcome in order to move forward from a stable platform. I am delighted to report that hard work, determination and a resolute focus on stringent cost management, positive trading and strong cash generation have combined to put us on a sound financial footing.

“The unwavering confidence and support of Endless and our customers, suppliers and staff have also been fundamental to this achievement and, with their continued backing, we have been able to foster a culture of continuous improvement that is driving everyone in the business to become best in class.

“At the beginning of 2010, we secured a £25 million financing deal with Royal Bank of Scotland, providing us with not only the resources for normal day-to-day trading, but also for substantial further capital investment in plant, machinery and the continued development of our distribution network via our Crown Decorator Centres.

“Trading in the first half of 2010 has exceeded budget expectations and the business is showing significant profit growth on 2009 levels. At the half-year point, we have also reduced operating costs by £2m and are £20m ahead of our cash forecast. However, as we head into the second half of the year, we expect this to tighten somewhat as inflationary pressures begin to take effect. The coatings industry as a whole is also facing a shortage of certain raw materials, which will inevitably impact on our cost base. Despite both of these factors, we are confident that our flexible and entrepreneurial approach, focus on working capital and ethos of working in partnership with customers and suppliers mean that we are well positioned for continued profit growth.

“Our plans for the remainder of the year include identifying further opportunities to reduce cost while improving the quality of our products and customer service. For example, restructuring our operations in Ireland will enable us to increase operating profit by around £1m while enhancing rather than sacrificing service levels. We also plan to invest a further £6m in infrastructure projects and e-commerce channels by the end of 2010, as well as pursuing further export and licensing agreements in the Middle and Far East. With almost £40m of headroom to execute our growth strategy, we are well placed to continue to increase market share throughout the remainder of the downturn while planning for the eventual recovery of the sector.”

Warwick Ley, partner at Endless, added: “We are extremely passionate about the work that is taking place at Crown and are proud to be associated with it. The business has performed ahead of expectation, particularly in 2010, and we are delighted with the way that the management team has tackled some particularly challenging market conditions.

“There is a genuine buzz and excitement around the business and Crown’s plans for the future mean that this is set to continue.”